3 Benefits of Investing in Private Real Estate

Michael Episcope, co-founder of Origin Investments

We are grateful to have the opportunity to republish a second exceptional post written by Michael Episcope, a co-founder of Origin Investments. This post, about the top three benefits of investing in private real estate deals. While I enjoy sharing my commercial real estate investing insights and have blogged about how to conduct due diligence, Michael’s expertise is well worth sharing with you. Enjoy.~Robert Kantor

3 Benefits of Investing in Private Real Estate

Private real estate offers many benefits to individual investors, such as high returns, portfolio diversification, and tax efficiency. Institutional investors have long understood the merits of this asset class and relied on it to gain stability that balances market uncertainty. Take Yale’s endowment—considered the gold standard for its exceptional performance; 10% of its investment portfolio is allocated to real estate. Not surprisingly, most endowments and pension funds follow a similar investment plan. But individual investors have only begun catching on to this strategy and started adding private real estate to their portfolios in the last few years.

Even knowing exactly what qualifies as private real estate can be confusing. In layman’s terms, it means direct ownership in a piece of physical real estate, such as land, an office building, apartments or self-storage facilities, with the intent of making a profit. Individuals can invest in private real estate by acquiring assets actively as a direct buyer, or passively with a private real estate investment firm, an online crowdfunding website or a non-traded private Real Estate Investment Trust, or REIT, which is not exchanged-traded and subject to market volatility.

But three things are not confusing: the main benefits of investing in private real estate. All three are explained in detail here to help investors make well-informed decisions about private real estate.

Benefit #1: Private Real Estate Generates High Absolute Returns

Private real estate offers investors the ability to generate high absolute returns. An absolute return takes into account appreciation, depreciation and cash flows to measure the amount of money an investment earns over time, and is expressed as a percentage gain or loss on the initial investment.

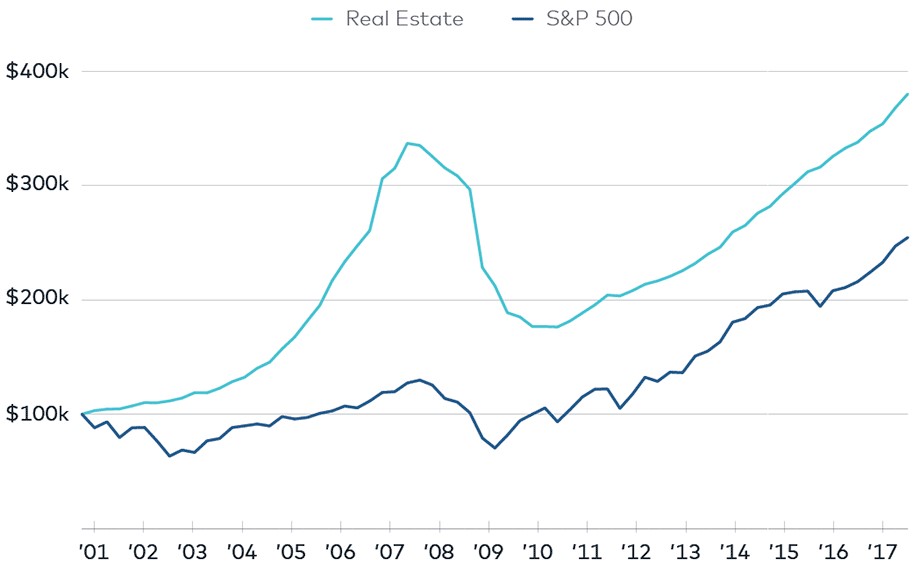

Looking at data from Preqin, a research company that tracks the performance of alternative investments, a $100,000 investment in private real estate beginning on January 1, 2001, would have been worth about $380,000 on March 1, 2017. That same $100,000 investment in the S&P 500 would be worth $255,000 on March 1, 2017, as illustrated in the chart below.

Preqin data

Benefit #2: Private Real Estate has Low Correlation to other Asset Classes

The goal of every portfolio is to create the highest total return with the least amount of volatility. Most investors are comfortable with a mix of stocks and bonds in their investment portfolios—until the markets’ ups and downs start making them nervous. Private real estate helps investors temper the volatility in their portfolios because it’s immune to the daily shocks of trading.

The value of a private real estate fund is based on the actual value of property held by the fund. Conversely, in a public REIT, the share price value is determined by daily market forces, which means the share price of a public REIT may not reflect the actual value of the underlying real estate. In some cases, the share price can value the REIT 30% higher or lower than the actual value of the underlying real estate.

Private real estate values don’t move much on a daily basis but rather appreciate slowly over time, which is why private investments are less volatile than their public counterparts. Both vehicles have pros and cons and the optimal portfolio has a combination of both. Public markets offer liquidity, but that comes at the expense of volatility and private investments offer investors low volatility, but with that comes illiquidity.

The chart below illustrates how private real estate has minimal correlation to stocks, bonds, and even public REITs, as measured by the National Council of Real Estate Investment Fiduciaries (NCREIF) property index (NPI), which looks at the returns of private institutional grade commercial properties.

| Russell 3000 | Barclays U.S. Aggregate | NAREIT | |

| NCREIF Real Estate | 0.23 | -0.24 |

0.13 |

Source: TIAA Asset Management

A correlation coefficient of 0 means that price fluctuations are not correlated at all. A correlation coefficient of 1 means that assets move together in tandem and a negative correlation means that they move in opposite directions to one another. An investment portfolio benefits greatly when it includes asset classes that are not correlated to each other.

Benefit #3: Private Real Estate is Tax Efficient

Investors who focus solely on an investment’s underlying returns and ignore its after-tax yields don’t recognize a big benefit of real estate investing. Income generated by properties is generally shielded through depreciation, providing investors with the long-term benefits of substantial cash flow and very little tax burden.

IRS rules allow owners to take annual losses in the form of depreciation to smooth out eventual capital expenditures as buildings age. However, only the physical elements of a property are subject to depreciation. Land can’t be depreciated and must be separated from the physical property value. For example, a multi-family property can be straight line depreciated over 27.5 years. If the property was acquired for $6 million and sitting on land worth $1 million, it will produce $181,818 in annual non-cash depreciation, as calculated by $5 million divided by 27.5.

In general, individuals will pay between 20% and 25% in taxes on real estate investments versus 37%, the highest tax bracket on ordinary income, for hedge funds and other alternative vehicles. So, if a property generates $100,000 of cash flow and $50,000 in depreciation, then the taxable income to the individual will only be $50,000. The tax liability, assuming an investor is in the highest federal tax bracket, is calculated as .37 x $50,000 or $18,500, which is the equivalent of an 18.5% tax rate on the entire cash flow of $100,000.

However, the depreciated portion of the property is subject to a recapture rate of 25% upon sale. Here’s how it is applied: if a property were acquired for $10 million and depreciated by $2 million, the cost basis for tax purposes would only be $8 million. The difference between the cost basis and the original purchase price is taxed at the recapture rate upon sale.

Additionally, any investment appreciation above the original purchase price, assuming the property has been held for more than one year, will be subject to the long-term capital gains rate of only 20%. Expanding on the example above, if the property were sold for $13 million, the difference of $2 million from the IRS tax basis of $8 million to the purchase basis of $10 million would be subject to the recapture rate of 25%. The gain from $10 million to $13 million would be taxed at the capital gains rate of 20%. The effective overall tax liability at sale would be $500,000 + $600,000, or $1.1 million.

Another tax benefit of real estate is the ability to defer taxes indefinitely through a 1031 exchange. The 1031 exchange tax provision allows real estate owners to sell a property and buy another property without incurring capital gains taxes. In theory, an investor could buy and sell properties without ever paying taxes on the gains. The ability to defer taxes into the future is one of the greatest attributes of owning real estate directly.

Finally, because private equity real estate is typically held in an LLC, which is considered a pass-through entity by the IRS, 100% of income, losses, and expenses pass through to the owners. Unlike corporations, where owners may be subject to double taxation (the corporation pays taxes on corporate net income and the owner pays on any dividend income they receive), the LLC itself does not get taxed. Instead, individual members are taxed on their share of the income, expenses, and losses reported on their year-end tax document, the K-1. They are taxed at their tax rate, which is often lower than the corporation’s.

To learn more about the possibility of earning long-term, reliable cash flow with Headwater Capital, contact Robert at RAKantor@HeadwaterCapital.com.