How the Brexit May Impact Foreign Investment in U.S. Real Estate

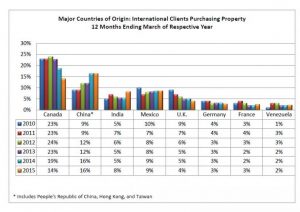

Photo: National Association of Realtors

The International Business Times recently reported on how the possible Brexit, the United Kingdom’s exit from the European Union, may impact foreign investment in U.S. real estate. The vote occurs Thursday, July 23. I found the following excerpts of particular interest to Headwater Capital and to our commercial real estate investors seeking stable, long-term reliable cash flow.

“With the Brexit vote looming Thursday, high-net-worth real estate investors — both individual and institutional — are eyeing New York and other gateway U.S. cities as safe havens, spooked by uncertainty that has crept into the London market in the last year, not only as a result of the contentious Brexit campaign, but also because of recent policy changes involving visa approvals and real estate taxes.

New York real estate attorney Edward Mermelstein said big-money foreign investors have been shifting to the U.S. market for the last year, and the turmoil generated by the Brexit campaign has escalated the trend. He added, “the commercial real estate market also will continue to attract foreign investment — in secondary markets, not just New York, San Francisco and Chicago.”

Lawrence Yun, chief economist at the National Association of Realtors, estimated that foreigners invested $80 billion in U.S. real estate last year. Overall, U.S. real estate is worth approximately $22 trillion, about 2 or 3 percent of it controlled by foreign investors.

What should investors keep in mind if the Brexit occurs? Since Headwater specializes in highly stable, demographically secure cash-flowing real estate, more and more investors are coming to Headwater Capital as to find a hedge against increasingly volatile markets, whether the Brexit occurs or not.

The complete article is available here.